General Introduction

Welcome to Uncovered Balances Bank, the specialized entity in financial investigations, frozen asset recovery, and global compliance analysis.

We provide professional solutions, and comprehensive to assist investors, individuals, and institutions in dealing with complex financial challenges, offering precise analysis of frozen assets to ensure compliance with international regulations and financial transparency.

Why Uncovered Balances Bank?

• An integrated team of financial analysts, legal experts in financial compliance, and specialists in digital asset tracking and blockchain technologies.

• Accurate financial and investigative analysis to detect illicit financial activities and determine the legal grounds for asset freezes.

• Collaboration with specialized global regulatory committees to ensure compliance with international regulations related to financial investigations and asset recovery.

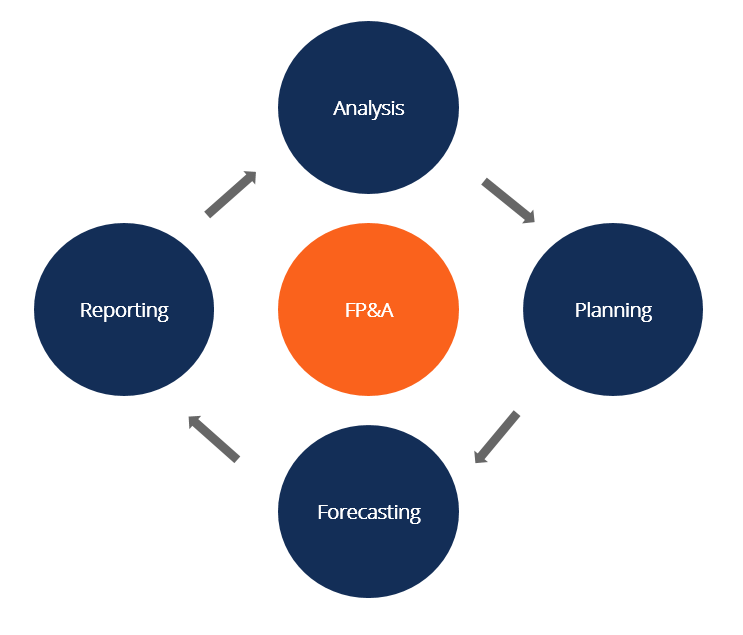

Learn more about our focus areas

The Client Support & Financial Assistance Department plays a critical role in ensuring a seamless customer experience, particularly in the sensitive field of financial compliance.

Frozen financial assets pose a complex challenge for individuals and businesses, preventing them from accessing and managing their funds freely. Addressing these assets

he rise of digital assets and investments in decentralized exchanges (DeFi) has brought significant financial innovation. However, it also presents high regulatory risks

The UBBank Audit & Compliance Review Department is a fundamental component in ensuring financial integrity, the effectiveness of internal control systems.

Who We Are?

Uncovered Balances Bank is a consulting firm specializing in financial investigations, compliance analysis, and tracking frozen assets.

We provide accurate legal and regulatory insights through financial data analysis, banking systems evaluation, and digital platform assessments to facilitate the recovery of frozen funds under global legal frameworks.

Our Mission

- To provide specialized financial consultancy and solutions to assist individuals and companies in recovering their financial rights through comprehensive financial data analysis, regulatory enforcement, and legal client support.

Our Vision

- To be the world’s most trusted institution in financial investigations and asset recovery, utilizing cutting-edge financial technologies and advanced investigative analysis.

Our Expert Team

Financial & Technical Analysis Specialists

Our team consists of financial experts, legal analysts, and AI-driven compliance specialists, ensuring precise financial transparency.

Digital Asset Tracing Specialists (DeFi & Blockchain)

• A specialized team in analyzing digital transfers, tracking blockchain transactions, and decoding suspicious activities in decentralized networks.

Our Advanced Analytical Approach

• We don’t rely on superficial analysis only, but conduct in-depth financial investigations that include tracking money flow, assessing regulatory risks, and identifying legal gaps in freezing processes.

Partnerships & Compliance

We operate under strict international financial protocols in collaboration with specialized regulatory committees, global oversight entities, and international financial investigation bodies to ensure legal compliance with frozen assets.

⃣ Regulatory Authority for Frozen Assets (RAFA)

What is RAFA?

RAFA is a global regulatory committee specialized in the oversight and analysis of frozen assets in accordance with international financial and legal standards. It plays a critical role in determining the legitimacy of asset freezes and their potential release.

Role in Our Operations:

Issuing regulatory reports on frozen assets and ensuring compliance with global financial regulations.

Analyzing the financial compliance of institutions holding frozen assets, based on international oversight standards.

Reviewing the impact of laws and regulations on decisions regarding the release of frozen assets.

International Financial Compliance Fund (IFCF)

What is IFCF?

IFCF is a global regulatory entity responsible for reviewing financial compliance of banking institutions, verifying financial licenses, and ensuring entities meet international financial standards.

Role in Our Operations:

Assessing financial compliance data for financial institutions and verifying compliance with all legal requirements.

Reviewing legal and tax risks associated with institutions holding frozen assets.

Issuing regulatory reports used in legal disputes concerning frozen assets.

These committees operate under the highest international financial protocols and play a strategic role in evaluating financial compliance and regulating global banking operations.

Solutions We Offer

Advanced Asset Tracing

Service Details:

• Analyzing bank records and financial transactions to identify the location of frozen assets.

• Tracking bank transfers, digital currencies, and electronic transactions to determine the reasons for asset freezes.

Benefit:

• Enables clients to understand the status of their frozen assets and assess the possibility of recovery under global financial laws.

Compliance & Licensing Analytics

Service Details:

• Verifying the legal status and financial licenses of investment institutions.

• Reviewing financial platform compliance with global regulations such as KYC and AML.

Benefit:

• Protects investors from fraudulent financial entities and ensures engagement with legitimate, licensed financial institutions.

Forensic Financial Reports

Service Details:

• Conducting a comprehensive analysis of money movement between financial entities and identifying suspicious transactions.

• Preparing analytical reports that can be used as legal evidence in financial disputes.

Benefit:

• Supports clients in legal cases and financial dispute resolution.

Asset Recovery Advisory

Service Details:

• Developing strategies for recovering frozen funds under international legal frameworks.

• Coordinating with international lawyers to ensure proper legal action.

Benefit:

• Increases the chances of recovering frozen assets through legal and transparent means.

Risk Profiling & Investment Assessment

Service Details:

• Analyzing the reputation of financial entities and assessing financial compliance risks.

• Providing financial consultancy to avoid engaging in high-risk or fraudulent investments.

Benefit:

• Reduces the risk of falling victim to financial fraud and ensures investment in reputable financial entities.

Financial Awareness & Compliance Education

What is financial compliance, and why is it essential for financial institutions?

Financial compliance is a set of rules and regulations imposed by regulatory authorities to ensure that financial transactions are conducted according to international laws.

Its objectives include:

- Preventing money laundering and terrorist financing.

- Ensuring that financial institutions operate transparently and comply with regulatory laws.

- Protecting investors from financial fraud and ensuring fair financial markets.

How can financial institutions be verified before engaging with them?

To verify any financial institution before dealing with them, follow these steps:

- Check licenses: Verify financial authorities such as FCA (UK), SEC (US), CySEC (Cyprus) to confirm valid licenses.

- Analyze compliance records: Review the institution’s history for any previous violations or legal complaints.

- Assess financial transparency: Ensure the institution provides clear financial data and is subject to independent audits.

What international regulations govern frozen assets?

Asset freezes are subject to strict global regulations, including:

- Anti-Money Laundering (AML) laws to prevent illicit money transfers.

- Know Your Customer (KYC) regulations to verify customer identities and prevent illegal activities.

- Tax compliance laws (FATCA, CRS) that require financial institutions to report foreign accounts to prevent tax evasion.

Legal & Compliance Analysis

Comprehensive review of international laws governing financial compliance and asset freezes.

Analysis of recent regulatory decisions and their impact on financial recovery operations.

Assessment of legal risks that may affect financial institutions’ ability to recover frozen funds.